Where work pays: How does where you live matter for your earnings?

Where work pays: How does where you live matter for your earnings?

Lauren Bauer, Audrey Breitwieser, Ryan Nunn, and Jay ShambaughTuesday, July 10, 2018

Facebook

Click to share on Facebook

Twitter

Click to share on Twitter

LinkedIn

Click to share on LinkedIn

Print

Click to print

More

DOWNLOAD

Full paper

Technical appendix

Editor’s Note: An interactive tool accompanies this economic analysis, allowing users to see the distribution of annual earnings across the United States for a given occupation and age group, adjusting for cost of living and taxes.

where work pays interactive

Educational and occupational choices matter for your earnings, but where you work matters, too. Employment opportunities and wages in some occupations vary substantially from state to state, county to county, and city to city. One location might be a great place to earn a living as a nurse but not as a construction worker (e.g., New Orleans, Louisiana), while a different location might be the opposite (e.g., Utica, New York).

Does it make sense for people starting or advancing their careers to move? And if it does, to where should they move?

Authors

lauren bauer

Lauren Bauer

Fellow – Economic Studies, The Hamilton Project

@laurenlbauer

audrey breitwieser headshot

Audrey Breitwieser

Senior Research Assistant – The Hamilton Project

Ryan Nunn

Policy Director – The Hamilton Project Fellow – Economic Studies

ryan_d_nunn

Jay Shambaugh

Director – The Hamilton Project Senior Fellow – Economic Studies

@JayCShambaugh

In this economic analysis we look at some of the ways that typical earnings in an occupation—and the value of those earnings after adjusting for taxes and cost of living—vary across the United States.[1] We also examine some of the reasons why places have such different labor markets. When a place seems too good to be true (i.e., with high wages across the board and low cost of living), what could account for its seeming advantage over the rest of the country?

Economists think about these differences in terms of a worker’s choice of where to live. Evidence suggests that people often move to find work or accept a job, but that there are many other factors that play a role in where a person chooses to relocate.[2] Cost of living (including housing costs) and taxes, as well as a host of other factors collectively referred to as amenities, all contribute to a choice about where to move. Research shows that workers value amenities like pleasant weather, clean air, low crime, and proximity to cultural attractions.

Over the past few years The Hamilton Project has released interactive web tools to help workers—and particularly young adults, from college hopefuls to recent graduates—make decisions regarding their education and careers. These web tools and associated reports also help illuminate workings of the labor market and their implications for educational investments, which in turn are vital for promoting broadly shared economic growth.

In our newest interactive feature, Where Work Pays: Occupations and Earnings across the United States, users can see how typical earnings in occupations vary across metropolitan (metro) and nonmetropolitan (nonmetro) areas in the United States. They can also see how earnings by occupation change when adjusted for age, cost of living, and state and federal income taxes.[3]

LOCATION AND OCCUPATION MATTER FOR EARNINGS

The median earnings for all working-age (25–64) full-time workers in the United States is $41,000, although deviations from this value are quite large. Education plays a large role in earnings differences: workers with less than a high school education have median earnings of $23,000, while those with an advanced degree have median earnings of $73,000. Median earnings range from $15,000 to $182,000 across 320 occupation categories.[4]

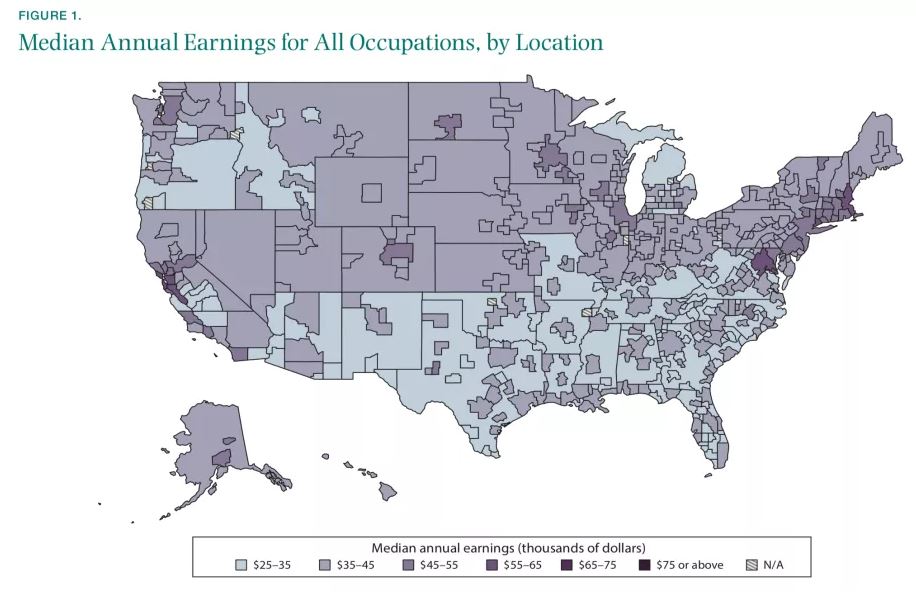

Geography matters a great deal for earnings, as well. The United States can be divided into metro areas (cities and their surrounding areas) as well as state nonmetro areas (the parts of a state not included in any metro area). Together, we use the term “locations” to refer to areas included in this analysis. There are 373 metro areas included in this analysis and 47 nonmetro areas; almost every state has one nonmetro area in our calculation.[5] At the bottom of the range, median earnings are $26,000 in Sebring, Florida, while at the top of the range median earnings are $65,000 in San Jose–Sunnyvale–Santa Clara, California.

How much does location matters for earnings? After controlling for demographic differences, workers in the top 30 locations earn an average of 20 percent more than the median worker in the United States and 37 percent more than workers in the bottom 30 locations; median annual earnings are substantially higher in some locations than in others (see figure 1). Still, given the huge variation in individual earnings, location can only explain so much of individual variation. Differences in educational attainment account for 16 percent of the variation in earnings across workers, while age, race/ethnicity, sex, and occupation explain an additional 20 percent of the variation. A further adjustment for location accounts for another 1.5 percentage points of earnings variation.[6] This relatively small value does not mean that location is unimportant, just that individual characteristics mean more than regional ones.

Median Earnings for All Occupations, by Location

TYPICAL EARNINGS VARY CONSIDERABLY WITHIN OCCUPATIONS AND ACROSS LOCATIONS

There are some occupations with relatively little variation in earnings across locations, but where you work has an impact on what you earn for the vast majority of jobs. Perhaps surprisingly it is not always the location with the highest overall earnings that has the highest earnings for particular occupations. For example, while San Francisco–Oakland–Hayward, California, ranks fourth out of all locations in terms of overall median earnings, it ranks below the national median for 9 percent of occupations. Conversely, locations with low overall earnings often feature higher earnings in certain lines of work. Nineteen of the lowest 20 wage locations have at least one occupation paid at the national median or better.

Earnings differences within occupations and across locations can be quite large. For example, median earnings of computer software developers are lowest in Lubbock, Texas ($49,600) and highest in Santa Cruz–Watsonville, California ($135,000). At the other end of the earnings distribution, kitchen workers earn the least in Indianapolis–Carmel–Anderson, Indiana ($11,300) and the most in San Francisco–Oakland–Hayward, California ($25,300). Recent work by David Deming and Lisa Kahn suggests that some of this variation within occupations exists because the same occupation requires a different set of tasks and skills in different locations.

To illustrate how wages vary within a particular occupation, figure 2 presents median annual earnings for registered nurses, one of the occupations with the largest number of workers, by location. Registered nurses have the highest earnings ($101,300) in San Francisco–Oakland–Hayward, California and the lowest ($40,000) in Valdosta, Georgia. In appendix figure 1, you can see how earnings increase with age within each separate location. The interactive associated with this report allows users to input any occupation to show median earnings by location and age.

Median Earnings for Registered Nurses, by Location

PLACES WITH THE SAME OVERALL EARNINGS NONETHELESS HAVE ADVANTAGES AND DISADVANTAGES IN PARTICULAR OCCUPATIONS

How much location matters to earnings—and in which locations a person would earn more—depends on the occupation. To illustrate how earnings vary within occupations by location, for figure 3 we selected 9 of the 20 most common occupations; each vertical line represents the median earnings in that occupation in a particular place. If an occupation’s wages are more variable across locations, as with registered nurses, then where you live matters more for your wages. For occupations with less dispersion, like truck drivers, where you live matters less for your wages.

To show how earnings in occupations vary when comparing the same locations, figure 3 highlights six metro areas with median earnings that are all roughly at the level of the median location in the United States.[7] Earnings dispersion for these locations with similar overall median earnings varies widely across the occupations we selected. For example, the median primary school teacher in Riverside–San Bernardino–Ontario, California, earn $66,900 ($27,200 above the median earnings for that metro area), while primary school teachers in Wichita, Kansas; Morgantown, West Virginia; New Orleans–Metairie, Louisiana; and Jacksonville, Florida, are paid close to the median earnings for those locations. By contrast, occupations such as truck, delivery, and tractor drivers, as well as construction laborers, have a much more condensed distribution, with similar earnings across the six metro areas.

There are meaningful differences in average wages across locations, but a substantial amount of variation remains at the location-occupation level, as figure 3 helps show. It is not always the case that places rank in the same order for any given occupation. Only 6 percent of occupations have a ranking that is correlated at above 0.5 with the ranking of overall median wages. In fact, more than two-thirds of occupations have a correlation below 0.3. In part, this could be due to differences in the mix of people working in different occupations.

Distribution of Median Annual Earnings across Locations, Selected Occupations

THE VALUE OF A DOLLAR DEPENDS ON WHERE YOU LIVE

Given that a select few metro areas in the West and the Northeast have the highest wages, we might expect many more people to move to these places than already have.[8] But wages are not the only consideration for people making decisions about where they choose to live and work.

One reason that many people choose to reside and work outside high-wage locations is a lower cost of living in other parts of the country. A lower cost of living—including cheaper housing, food, education, transportation, and other goods and services—allows the same dollar of wages to stretch farther. A worker in a metro area with a relatively low cost of living (e.g., Dallas) might think twice before accepting a slightly better-paying position in a metro area with a higher cost of living (e.g., San Francisco).

Cost of living in the San Francisco metro area is not high simply because it is dense or because residents earn a high wage, however. Deliberate policy choices such as land-use restrictions have contributed to sharply rising rents and home prices, limiting the number of people who can access the economic opportunities in high-wage cities.[9] This in turn limits U.S. economic growth and allows a divergence between incomes in different places.

What does this mean for individual workers? Using the Bureau of Economic Analysis’ (BEA’s) regional price parities (RPPs), we can see just how much higher or lower the cost of the same bundle of goods and services is in each location relative to the national average cost. The RPP is calculated using prices from the Consumer Price Index and housing rents from the American Community Survey; each location’s RPP represents how much higher or lower (in percent terms) prices are in that location compared to the U.S. average.

Table 1 shows 12 locations with the same annual median earnings ($40,505) but different costs of living, giving a sense of how substantially cost of living can vary across the country. Santa Fe, New Mexico, has a cost of living index (–0.2) just slightly below the national average. By contrast, the cost of living in Auburn–Opelika, Alabama, is about 15 percent lower than the national average, while the cost of living in Atlantic City–Hammonton, New Jersey, is almost 4 percent higher. When adjusted for cost of living, $40,505 in earnings is worth $47,900 in Auburn–Opelika, Alabama, whereas in Atlantic City–Hammonton, New Jersey, that same $40,505 is worth only $39,100.

Median Annual Earnings with and without Adjustment for Cost of Living, Selected Locations

Figure 4 shows median annual earnings versus cost-of-living index by location and region.[10] Note the clear upward sloping relationship: higher-earning areas (the x-axis) tend to be those with higher cost of living (the y-axis). In fact, there are no locations with a cost of living above the national average that have earnings less than $32,000, and no locations with a cost of living below the national average that have median earnings above $50,000. For every $1,000 more in earnings the cost of living is on average 1 percentage point higher. For example, moving from a $40,000 to a $50,000 median wage location would lead to a cost-of-living index that is 10 percentage points higher, offsetting 44 percent of the increased salary. The figure also shows that metro areas in the West and Northeast tend to have higher costs of living than do metro areas in the South and Midwest. After adjusting for cost of living, locations in the Northeast and Midwest tend to feature the highest earnings.

Median Annual Earnings versus Cost-of-Living Index, by Location and Region

While income taxes do not vary as much between regions as does the cost of living, taxes are an important consideration when comparing wages across the country. It might be more difficult to interpret differences in taxes than it is to interpret differences in cost of living, however. States with high taxes spend some of their extra revenues on public goods that are valued by residents, which partially offsets the burden of income taxes. Figure 5 shows the importance of these adjustments, plotting unadjusted median annual earnings versus earnings that are adjusted for both cost of living and federal and state income taxes, by location.[11] To be clear, this figure does not provide a full picture of local tax burden, which can vary additionally through sales taxes and the relative weight of income and property taxes. Locations with high unadjusted earnings also tend to have high adjusted earnings; there is a clear upward sloping relationship in the figure. However, the relationship is not one for one: some of the higher earnings are eroded by taxes and cost of living. In other words, higher cost of living and taxes reduce—but do not eliminate—the labor market advantage of high-wage locations.

Median Annual Earnings versus Cost-of-Living- and Tax-Adjusted Earnings, by Location

HOW TO THINK ABOUT CHOICE OF LOCATION

People choosing where to live and work generally factor in their future earnings, cost of living, and taxes. However, these are not the only relevant considerations. Amenities such as temperate weather, air quality, nightlife, and cultural attractions are all nonwage benefits that differ from location to location. By knowing their own relative preferences for these amenities as well as for earnings, workers can make decisions about the best location for them.

The difficulty for researchers is that the values of amenities—unlike the value of wage earnings—cannot be directly observed. Instead, an indirect approach is used: researchers examine workers’ implicit willingness to accept lower wages and/or a higher cost of living in exchange for amenities that they value. An example of this is that many cities in the West (often those on the coast) have high costs of living relative to their median earnings (as can be seen in figure 4). This may reflect that these cities are attractive places to live, leading many people to accept slightly lower cost-of-living-adjusted wages in order to live there.

This approach to estimating amenities has proven very useful, particularly when adjustment is made for taxes and nonhousing cost of living, as has been done in a number of recent papers by economist David Albouy and others.[12] For instance, one common assertion is that postwar migration to the South occurred because of an increasing taste for sunshine and warm weather. However, work by economists Edward Glaeser and Kristina Tobio shows that this was likely not the case, given the extent to which cost-of-living-adjusted earnings have risen in that region.

Amenities are not experienced in the same way by all people. Overall, less-educated workers are less willing to pay for amenities while more-educated workers are willing to pay particularly high premiums for amenities such as restaurants and clean air, for example.

CONCLUSION

The Hamilton Project has released a series of interactives that help people see how the decisions they make help shape their earnings over time. With Major Decisions, users can input different postsecondary majors to see age-earnings profiles and lifetime earnings by major. In Putting Your Major to Work, users can input an academic major, gender, and age group to see the top occupations as well as median earnings and work status for people with that major and in those occupations. The most-recent interactive—Where Work Pays: Occupations and Earnings across the United States—allows users to select an occupation and age group and to adjust for cost of living and tax expenses to examine the distribution of earnings across the United States by metro/nonmetro areas or by state.

Educational and occupational choices matter a great deal to workers’ careers. In addition, where workers choose to live matters significantly in many occupations. As this economic analysis has shown, there is a wide range of wage outcomes across locations in the United States. Typical pay is substantially higher in some locations than in others, though the location of the highest pay varies depending on occupation. Higher pay is sometimes partially offset by higher cost of living and taxes, depending on location, but higher cost of living and taxes are balanced in some locations by nonwage amenities that attract workers. Understanding how all of these factors—earnings, cost of living, taxes, and amenities—vary across the country is necessary for a complete account of labor market outcomes.